By Sharada Saraf | SQ Online Editor | SQ Online (2017-2018)

[hr gap=”10″]

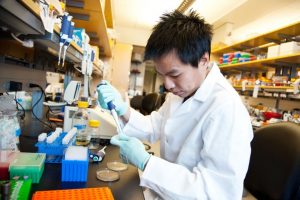

They’re the teaching assistants who ensure that papers are graded and students understand challenging concepts. They’re the essential drivers behind the high impact research that the UC system produces. They’re the ones who demystified organic chemistry for you, helped you pipette for the first time, and responded to desperate emails when your professors didn’t. Working in virtually every classroom and laboratory, graduate students are what make research institutions like UC San Diego dynamic centers for scientific education and discovery. Therefore, it is difficult to come up with a justifiable reason as to why the Republican-led House passed a tax proposal a few weeks ago that, among other things, targets the tuition waivers that cover the cost of a graduate education.

How graduate school typically works is fairly straightforward: PhD students teach and conduct research in exchange for a taxable stipend: for students seeking a doctorate from the Division of Biological Sciences at UCSD, this stipend is around $33,000/year (the average salary in San Diego is almost double this amount: about $60,000/year). While the university still technically charges students tuition, this fee is either waived or covered by grant money.

Under the House tax proposal, this tuition waiver, which is the reason why many are able to pursue careers in academia in the first place, would become taxable income. At UCSD, where waived graduate education costs are around $40,000 annually, graduate students would be taxed as if they actually made that much money in addition to the $33,000 yearly stipend received from the university. (Hint: most don’t.)

Graduate students, many of whom already work under economically difficult conditions, could see their taxes more than double under this version of the tax bill. Those who enter graduate school already burdened with debt from their undergraduate degree would certainly find it extremely difficult, if not impossible, to continue their education. The resulting financial burden can and will drive current and future grad students out of American research institutions, straining laboratories and classrooms and endangering the future of research.

PhD programs have traditionally been the financially accessible way to pursue a more advanced degree without having to shoulder the heavy costs that come with moving on to professional schools. Under this tax plan, undergraduate biology students hoping to take more specialized courses of study would face a significant financial burden whether they choose to apply to a health professional school or graduate school. A bachelor’s degree is already a major expense for many students; now, any degree past college could essentially bankrupt students.

While the recently-passed Senate version of the proposal doesn’t contain the same provisions targeting graduate students, the House and Senate versions of this piece of legislation must be compromised before the final version of the bill is sent to the Executive Office. Despite the dozens of nationwide walkouts and rallies, including a recent one at UCSD, it’s still unclear as to whether these provisions will be included in what President Trump signs into law. Even if they aren’t, it is disturbing to the graduate students that have to fear for the future of their academic careers in the first place, and upsetting to those hoping to earn PhDs in the future.

The fact that this type of an unprecedented tax hike on graduate students was passed in a legislative chamber at all speaks to a troubling trend of higher education being devalued in the United States. In May of this year, SQ Online published several pieces regarding the current administration’s desire to cut billions of dollars in research grant funding, and the resulting outcry from scientists and universities across the country. There are far-reaching consequences of not investing in the United States’ educational future, and making graduate education something attainable only by the wealthy shuts out those who are already underrepresented in the scientific community.

In a survey conducted by the University of California in 2016, over 40 percent of undergraduates planned to apply to graduate school following the attainment of a bachelor’s degree. If the tuition waivers becomes taxable, the many UC students who take out loans, are first-generation, and/or are financial aid recipients may reconsider their aspirations in favor of a more financially viable option.

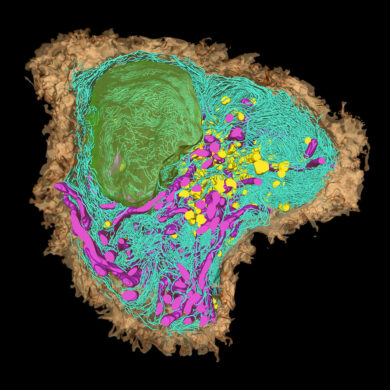

For UCSD’s Division of Biological Sciences in particular, this type of fear and uncertainty jeopardizes the future of an institution whose graduate students ensure the tradition of faculty-student collaborative research. Life-saving work on diseases like cancer to viruses like Zika can be potentially slowed down significantly, and the scientific community suffers from the loss of those who have the capability to contribute significantly to research, but are unable to afford to attend the institutions producing that research.

The impact of this kind of tax policy cannot be overstated. Highly educated people dedicated to scientific advancement are vital to academic and research progress in this country; by creating an environment that is hostile to this sort of progress, this administration does a disservice to aspiring scientists and drives out those with promising research to countries who are more willing to support their endeavors. By removing tuition waivers that extend the possibility of excelling in a field to a diverse audience, this administration will be guilty of killing the academic careers of those committed to progress and innovation in the United States.